single life annuity vs lump sum

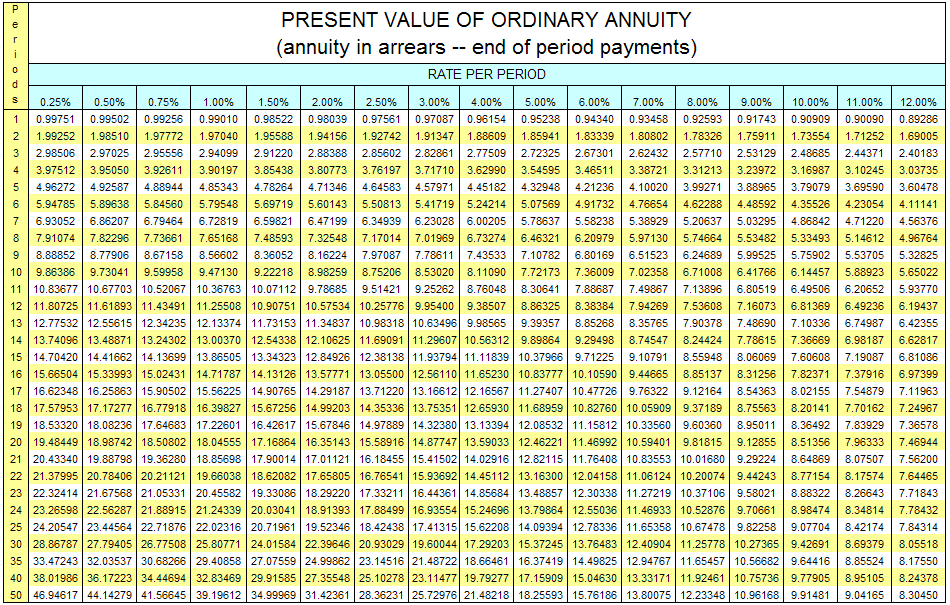

The savings interest rate that you designate is used to calculate present value for the annuity payment option and is compounded monthly. This makes the single life annuity attractive of course.

Annuity Beneficiaries Inheriting An Annuity After Death

A single life annuity is a specific type of annuity product and defines a way to structure your annuity payments.

. Ad Learn More about How Annuities Work from Fidelity. Of them all the single life annuity offers the highest monthly payout. However this benefit comes with a substantial challenge.

Single life annuities are an attractive annuity payout option because they offer the highest monthly payouts of all the payout options. Making that money last. Pension Annuity vs.

DistributeResultsFast Is The Newest Place to Search. An annuity is a series of payments made at regular intervals over a certain period of time or until deathwhichever comes first. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life.

In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average through retirement to make it last for 18 years. In fact the 300000 would last a little over 17 years even with a 0 return 300000 17640 17. According to reports retirees with pension income were far more financially stable than those who opted for a lump sum.

A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Annuity vs Lump Sum. Statistics show that sticking with an annuity is often the wisest move for a lot of Americans.

Ad Want to Learn More About Annuities. However there is one big potential drawback to a single life annuity. SPIAs are commodities that need to be shopped using an.

Choose from pensions that are for a single life Joint and survivor or a life with 10 years certain. However this doesnt mean that opting for a lump sum payment is always a bad idea. Any money remaining at death goes to designated beneficiaries.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Annuities are often complex retirement investment products. Ad Learn How Jackson Can Help You Get Started On Your Journey To Financial Freedom.

A lump sum is a one-time payment. If you are the retiree and take a lump sum its not just you who can. Truth is annuities are often the better deal says Bob Kargenian an Orange California-based financial adviser noting that companies offering these buyouts are doing so to help their bottom line not yours.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Searching Smarter with Us. Its a single large sum of money that you receive all at once.

Read the Other Advantages an Income Annuity Provides How You Can Benefit from One Today. Everything You Need To Know. The single life annuity is just one of many varieties of life annuities that can help fund retirement.

Learn some startling facts. Buy What You Need Not What Someone is Sellin Stan Haithcock The Annuity Man April 29 2020 There are over 10000 baby boomers reaching retirement age every single day and many are faced with the decision to take a lump-sum dollar amount or an annuity payment from their employer. Be sure to consider the annuity option if.

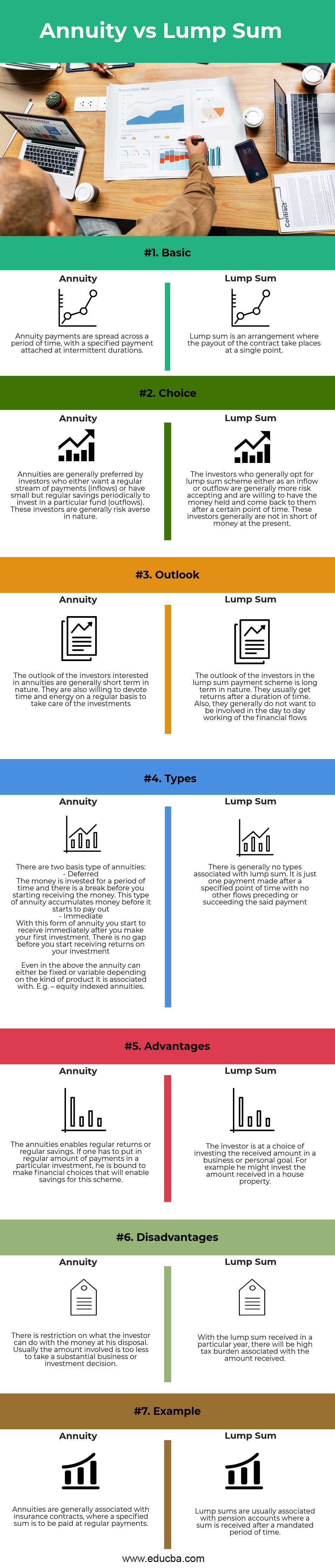

Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum is a payment of the whole amount due at once and the whole amount is received in one payment on the discretion of an investor. Key Differences Between Annuity vs Lump Sum. For instance if you elect a single-life annuity with a 10-year period-certain option then if you passed away four years after you started.

Let us discuss some of the major differences between Annuity vs Lump Sum. Understand What an Income Annuity is How it Works. Is a lump sum offer from an employer a better choice than a pension annuity for life.

An annuity provides a lifetime steady stream of income while a lump sum is a one-time payment. Find out what the required annual rate of return required would be for your pension plan options. Generally the option with a higher present value is the better deal.

Ad Find Relevant Results For Lump Sum Vs Annuity. Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for their day-to-day life after they stop working. Dont Buy An Annuity Without Knowing The Hidden Fees.

The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing. Protect Your Retirement Income With Jackson. Annuity or Lump Sum.

A large cash payment now. Ad See If An Annuity Is Right For You. What Is a Single Life Annuity.

Annuity payments are higher for single life annuities than they are for joint life annuities. And that makes perfect sense if all of the. Difference Between Annuity and Lump Sum.

The main benefit though is the flexibility to invest the lump-sum payment. A thinning of an employee base that takes place when a companys benefits plan has insufficient funds to cover the expenses associated with paying the employees earned. The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected.

This is consistent with what we saw in the insured annuity quotes as well providing additional insight that the monthly pension may be the favorable option. Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. Both options offer retirees.

The former provides an immediate up-front amount say 300000 but the pension annuity gives you a stream of. Often the decision to take a pension annuity option over an available lump sum option rests on which option provides the greatest income. The decision between cash up front and payments over time mostly depends on the interest rate that you can earn on money that you save and.

Annuity consists of regular payments over a period of time whereas the flow of a lump sum is at a designated singular point in time.

So You Won The Lottery Is The Lump Sum Payment Best Winning The Lottery Lottery Sum

Canadian Lottery 1000 Week For Life Vs 780k Lump Sum Over 60 Years Invested Oc R Dataisbeautiful

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Critical Illness Insurance Also Referred To As Critical Care Insurance Or Critical Illness Coverage Critical Illness Insurance Critical Illness Critical Care

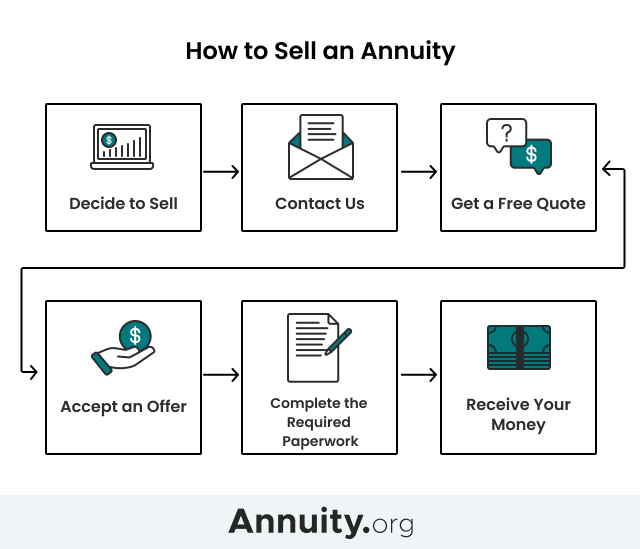

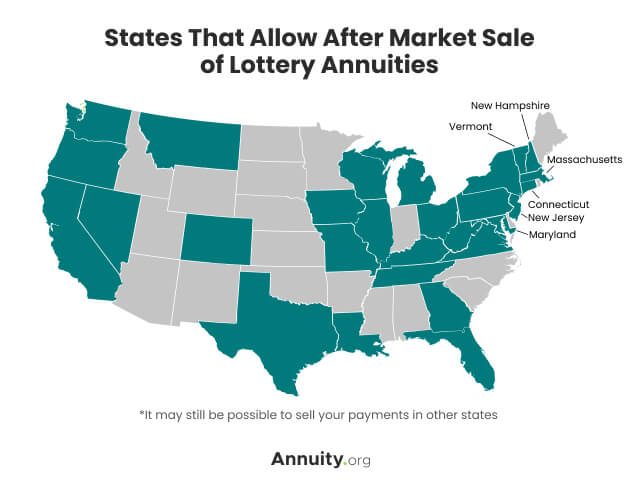

How To Sell Your Annuity Payments For Cash Step By Step Guide

Annuity Payout Options Immediate Vs Deferred Annuities

Lottery Winner S Dilemma Lump Sum Or Annuity

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Annuity Assist How Annuities Work Infographic Finance Investing Annuity Financial Education

Return Rate On Investment Annuity State Lottery Winning The Lottery

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Annuity Beneficiaries Inherited Annuities Death

Strategies To Maximize Pension Vs Lump Sum Decisions

Lottery Payout Options Annuity Vs Lump Sum

Lottery Payout Options Annuity Vs Lump Sum

When Can You Cash Out An Annuity Getting Money From An Annuity

Lump Sum Payment Definition Finance Strategists

How Did You Feel At The Crossroads Of Deciding To Take Early Retirement Or Continuing On If You Had An Option Did You Cash Out With A Lump Sum Or Opt For